Can Money Buy Happiness? Minimum Income to Retire in Singapore, based on a survey

We all know the typical way of mathematically planning for early retirement – know or guess how much you spend now or want to spend in future, extrapolate that to your target retirement age based on some assumed inflation rate, multiply by 33 or 25 and voila, that’s the target amount.

If you prefer a broader population wide approach, there have also been previous studies looking at the amount which you will broadly need to retire in Singapore. FYI, its $1,379 a month for a single and $2,351 for a couple above 65, for the most basic standards of living. This standard assumes no air-con, no car, and no healthcare or long term care costs. So, if this sounds like your life you can take these amounts, adjust for inflation until your target early retirement age, multiply by 33 or 25 and there you go, work is done.

These retirement planning approaches are simple yet sound. They might even work! However, they don’t answer what to me is the key question. Will this amount make you satisfied, or even happy in early retirement?

While that is definitely a personal question which I cannot even answer for myself, we now have some data, courtesy of the Singapore 2022 Quality of Life Survey, to provide some other broad guidelines on how we arrive at a figure suitable for us.

More money = more happy?

First, a recap of what we already know about the income-happiness relationship from academic studies.

One. more money = less sad

Two. more money ≠ (linearly) more happy

To be clearer, more money = more happy for people earning below the median income. As people move up the income quartiles, happiness levels from increased income tends to plateau.

Why this is so could really be because we are all, deep down, that aunty who loves comparing everything. It really could be worse psychologically to be the poorest rich person than the richest poor person. If you only own a Mercedes but your neighbour a Rolls, you can and definitely should cry in your car. People are weird.

Mixed metaphors aside, what did the survey actually find?

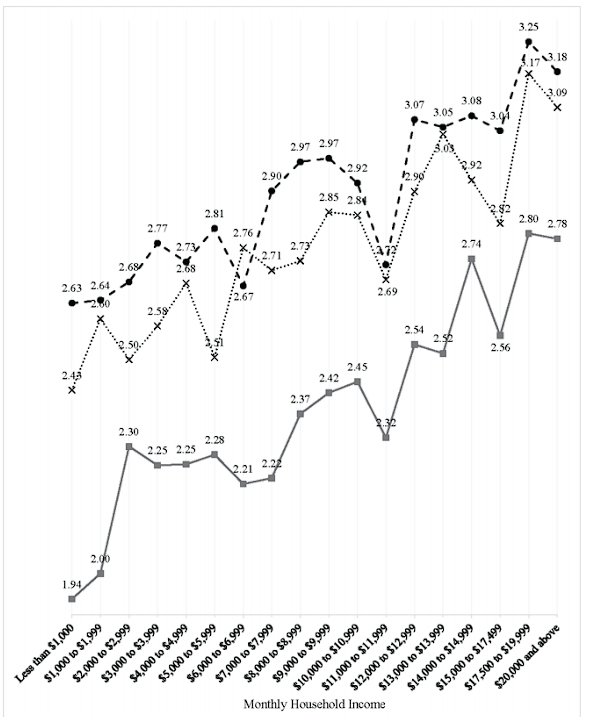

1. As per the overview, Singaporeans’ level of happiness, enjoyment and achievement generally increased linearly with monthly household income. Diving into the details, the chart is more like an ever increasing roller-coaster:

a) there is a sharp jump in happiness up to $3,000 in income, then

b) small ups and downs, until another jump at $8,000

c) smaller increase, until a drop at $12,000, and finally,

d) ups and downs for incomes above $12,000, such that somehow those earning $15,000 were materially less happy than those earning $13,000, and those earning more than $20,000 were marginally less happy than those earning $17,500.

2. On an absolute level, happiness levels in the middle income group (in Singapore’s context, $7,000 to $11,000) were not much lower than those earning $12,000 to $18,000.

3. Unlike happiness, satisfaction with life did generally increase linearly with income.

4. Compared to actual income, perceptions of own socio-economic status were actually more strongly correlated with wellbeing.

Of course, the survey also goes into what happier Singaporeans generally value. Like all good Singaporeans, I love being spoon-fed answers rather than figure it out myself, so that will be the next article (link).

Takeways for a TL;DR?

The Singapore 2022 Quality of Life survey overall corroborates previous international and Singaporean studies. Income past a certain level might not make you happier as the hedonic treadmill is real, but will at least generally let you be more satisfied with life. Somewhat facetiously, you might also want to compare less with people around you (or compare with different people) so your perception of your socio-economic status is warped, and you can fool yourself into becoming happier.

More practically though, the survey does provide some useful baselines for the total net worth you want to hit before retiring, and some alternative numbers you can consider putting in your early retirement planning excel sheet (I can’t be the only one with one). Even in going back to the basic personal approaches for retirement planning, in deriving those numbers, at least you now know more isn’t necessarily better.

In terms of amounts to target based on Singapore population wide satisfaction or happiness levels though, you should definitely aim for at least $3,000 a month. If you would like more comfort, maybe consider if $7,000 a month would be sufficient compared to $12,000 a month. The difference in happiness isn’t all that great, but does lead to a nearly $2,000,000 differential in target net worth (at a 3% withdrawal rate). That would mean even less years grinding for it at your job, and how can that even earlier retirement not make you happier now?

If so, no better time to start than now!

You can now be our community contributor and make a pitch to have topics you are most curious off and favourite personality be on our show.

Join our community group and drop us your insights on this topic.

![1M65 & Getting to $1 Million By 35? [Chills 61 with HoneyMoneySG]](https://thefinancialcoconut.com/wp-content/uploads/2024/03/Chills-with-TFC-thumbnail--440x264.png)

![Is CPF Life The Right Fit For Your Retirement Plans? Ask Yourself These 3 Questions [First Dibs 189]](https://thefinancialcoconut.com/wp-content/themes/Extra/images/post-format-thumb-text.svg)