Business

Want to know how successful businesses really adapted from street flyers to social media dominance? Tired of sugar-coated success stories that skip the messy middle? We bring you gives you the unvarnished truth about business evolution, straight from entrepreneurs who've lived it. No fluff, no filter - just real strategies you can implement today.

How to get started?

Plan Ahead

The key to retiring well is planning early and often. Start by estimating your retirement income needs - factor in your desired lifestyle, healthcare costs, travel plans, and other expenses. Then, work backwards to determine how much you need to save. Use online retirement calculators and speak to a financial advisor to get personalised projections.

Maximise Your CPF

The Central Provident Fund (CPF) is the cornerstone of retirement planning for Singaporeans. Understand how to optimise your CPF contributions and withdrawals to maximise your retirement savings. Explore the various CPF investment options to grow your nest egg.

Diversify Your Investments

While CPF is a reliable foundation, you'll also want to build a diversified investment portfolio to supplement your retirement income. This could include stocks, bonds, real estate, and other asset classes. Speak to a qualified financial advisor to develop a personalized investment strategy.

Manage Debt Wisely

Pay off high-interest debts like credit cards before retirement. This will free up cash flow and reduce financial stress. Consider consolidating loans or negotiating better terms with creditors.

Stay Healthy & Manage Healthcare Costs

Your health is your wealth in retirement. Prioritise preventative care, maintain an active lifestyle, and invest in your mental well-being. With rising medical expenses, healthcare planning is crucial. Familiarize yourself with MediShield Life, Integrated Shield Plans, and other government schemes to ensure you're covered. Factor in potential long-term care needs as you get older.

Find Fulfillment

Retirement is not just about money - it's about finding purpose and fulfillment. Explore new hobbies, volunteer, or start a small business. Staying socially engaged and intellectually stimulated can lead to a happier, more meaningful retirement.

Exploring Geoarbitrage to Stretch Retirement Funds

Geoarbitrage is the concept of taking advantage of cost-of-living differences between different geographical locations to maximise your purchasing power and stretch your retirement funds.

Remember, there's no one-size-fits-all approach, so stay flexible, seek expert guidance, and find what works best for your unique circumstances.

Latest Read

In an era of rising global trade tensions, Malaysia finds itself at a crossroads. With the US...

In an era of rising global trade tensions, Malaysia finds itself at a crossroads. With the US...

In today's fast-paced business world, the importance of mentorship cannot be overstated. It's a...

Singapore's government has reacted strongly to the U.S. tariffs imposed by President Donald Trump,...

TLDR; Singapore hit with 10% baseline tariff—higher than expected for a close U.S. ally China faces...

-1.png)

Side Hustle Smartly

- Explore with us the benefits and considerations of taking on a side gig or freelance work.

- Build your framework for evaluating viable side hustle ideas and managing the additional workload.

- Monetise hobbies, leverage skills, and scale a side business. See how the pros have done it.

-3.png)

Career Growth Tactics

- Obtain methods for advancing one's career, such as building a personal brand, networking effectively, and seeking out mentorship.

- Highlight soft skills and leadership qualities that can make professionals more promotable.

- Gain insights on navigating organisational politics and office dynamics.

The Good Reads

U.S. President Donald Trump has just raised the stakes by slapping a massive 125% tariff on China....

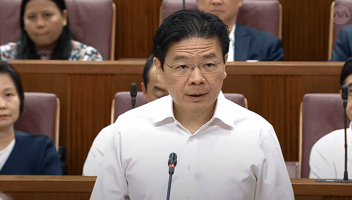

On March 25, 2025, Singapore’s Deputy Prime Minister Heng Swee Keat visited Baidu’s Apollo Park in...

The SGX-B3 partnership aims to launch BRL futures contracts on the SGX platform for Asian...

BYD, China’s electric vehicle (EV) giant, has stunned the automotive world with its 1,000 kW DC...

Other Interesting Reads

Weekly wisdom in your inbox

Get comprehensive guidance on saving, planning, and transitioning into your golden years.

Popular Videos

Popular Podcast Episodes

-3.png?width=50&name=Square%20(2)-3.png)