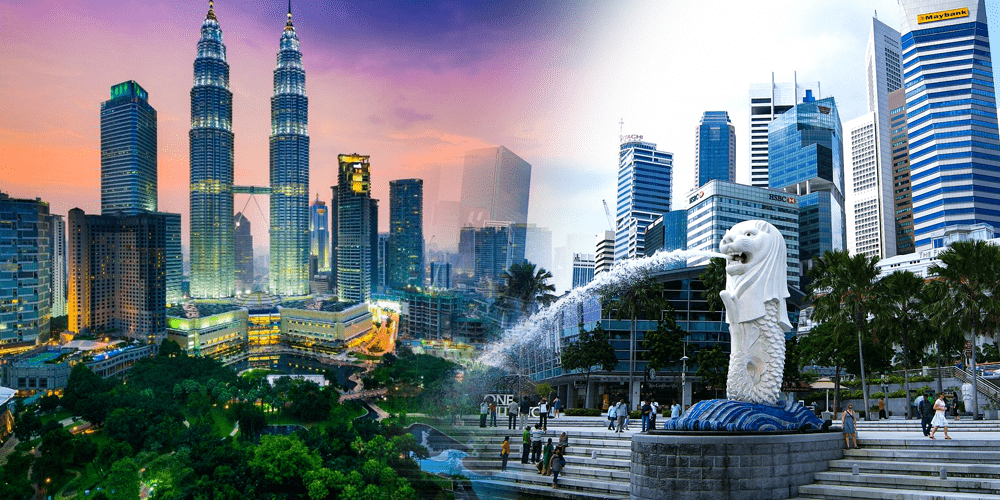

Why Malaysia is the Go-To Destination for Singaporean Entrepreneurs

Imagine the bustling streets of Singapore, where entrepreneurs dream of expanding their businesses but face rising costs and fierce competition.

Many Singaporean entrepreneurs are eager for growth yet find themselves constrained by the high cost of living and limited market opportunities.

In this context, Malaysia emerges as a prime location for business expansion, offering a wealth of opportunities just a stone's throw away.

Malaysia presents a compelling blend of geographical proximity, cultural affinity, and economic advantages that make it an ideal destination for Singaporean entrepreneurs seeking growth and opportunity.

This article will explore key factors such as cost advantages, market access, infrastructure, talent pool, quality of life, and potential challenges to consider when venturing into this vibrant market.

Malaysia’s Specific Tax Incentives Offered to Foreign Investors

The Malaysian government offers a variety of tax incentives aimed at attracting foreign investors, particularly in key sectors identified for growth. Here are the specific incentives available:

1. Pioneer Status (PS)

- Tax Exemption: Companies granted Pioneer Status can enjoy a partial or total exemption from income tax for a period of 5 to 10 years. The exact duration and percentage of exemption depend on the nature of the business and its contribution to the economy.

- Eligibility: This incentive is available for companies engaged in promoted activities such as manufacturing, agriculture, tourism, and high-technology industries. Applicants must submit their proposals to the Malaysian Investment Development Authority (MIDA) before commencing operations.

2. Investment Tax Allowance (ITA)

- Allowance Rate: Companies can receive an investment tax allowance of 60% on qualifying capital expenditures (QCE) related to approved projects. This allowance can be offset against 70% of statutory income for each assessment year.

- Duration: The ITA is applicable for expenditures incurred within five years from the date of the first qualifying expense.

3. Special Economic Zones (SEZs)

- Income Tax Exemption: Businesses operating within SEZs may qualify for income tax exemptions ranging from 70% to 100% for up to 10 to 15 years, depending on their investment levels and sectors.

- Additional Benefits: SEZs also offer investment tax allowances equivalent to 100% of total expenditure, as well as exemptions from stamp duty and import duties on approved activities.

4. Green Technology Incentives

- Companies involved in green technology projects may be eligible for additional incentives, including income tax exemptions of up to 70% on statutory income for a period of up to 10 years, specifically targeting sectors like renewable energy and electric vehicles.

5. Tax Breaks for High-Value Investments

- Recent initiatives under Budget 2025 propose new tax breaks aimed at attracting high-value investments in sectors such as integrated circuit design, artificial intelligence, and sustainable technology.

6. Other Notable Incentives

- Double Deduction Incentives: Certain expenses related to research and development (R&D), training, and environmental protection activities may qualify for double deductions.

- Import Duty Exemptions: Various sectors can benefit from exemptions on import duties for machinery and equipment used in approved projects.

Proximity and Cultural Affinity

Geographical Proximity: The short distance between Singapore and Malaysia facilitates easy travel and communication. Entrepreneurs can make quick trips to establish connections, manage operations, or attend meetings without the hassle of long-haul flights.

Cultural Similarities: Both countries share cultural elements that ease business interactions. The understanding of social norms and business etiquette allows for smoother negotiations and collaborations.

Language Advantage: English is widely spoken in Malaysia, significantly reducing language barriers for Singaporean entrepreneurs. This common language fosters effective communication in business dealings.

Established Trade Relations: Strong trade ties between Singapore and Malaysia create a favourable business environment. The ASEAN Free Trade Area (AFTA) further enhances these relations by reducing tariffs, making it easier for businesses to operate across borders[1].

Cost Advantages

Lower Cost of Living: The cost of living in Malaysia is significantly lower than in Singapore. This benefits both businesses and employees, allowing entrepreneurs to stretch their budgets further.

Affordable Real Estate: Malaysia offers cheaper office space and industrial properties compared to Singapore. This affordability makes it easier for startups and expanding businesses to secure suitable premises without breaking the bank.

Competitive Labour Costs: Labour costs in Malaysia are lower than in Singapore. This advantage allows businesses to hire skilled professionals at more affordable rates, thus reducing overall operational expenses.

Tax Incentives and Benefits: The Malaysian government provides various tax incentives to attract foreign investment. These incentives include tax holidays and exemptions that can significantly enhance profitability for new ventures.

Market Access and Growth Potential

Larger Market: With a population exceeding 32 million and a growing middle class, Malaysia offers access to a broader consumer base. This demographic shift presents numerous opportunities for entrepreneurs looking to tap into new markets.

Gateway to Southeast Asia: Malaysia serves as a strategic hub for accessing other Southeast Asian markets. Entrepreneurs can leverage this position to expand their reach into neighbouring countries with relative ease.

Emerging Industries: Specific sectors in Malaysia, such as technology, e-commerce, and manufacturing, are experiencing rapid growth. Entrepreneurs can benefit from investing in these emerging industries that promise significant returns.

Government Support for Innovation: The Malaysian government actively promotes innovation through various initiatives aimed at fostering entrepreneurship. Programmes that support startups with funding and mentorship are becoming increasingly prevalent.

Infrastructure and Connectivity

Developed Infrastructure: Malaysia boasts well-developed infrastructure encompassing transportation networks, communication systems, and utilities. This robust infrastructure supports efficient business operations across various sectors.

Digital Connectivity: The improving digital infrastructure in Malaysia is crucial for online businesses and e-commerce platforms. As internet penetration increases, so does the potential customer base for digital services.

Ease of Setting Up Business: Registering a business in Malaysia is relatively straightforward compared to other countries. Entrepreneurs can choose from various business structures such as private limited companies or sole proprietorships.

Talent Pool

Availability of Skilled Labour: Malaysia has a diverse pool of skilled professionals across various industries. Entrepreneurs can find talented individuals who meet their business needs without extensive recruitment efforts.

Growing Talent Ecosystem: The increasing number of universities and training institutions contributes to a growing talent pool equipped with relevant skills for modern industries.

Cost-Effective Talent Acquisition: Hiring skilled professionals in Malaysia is often more cost-effective than in Singapore. This allows businesses to maintain quality while managing payroll expenses effectively.

Quality of Life

Affordable Living: The lower cost of living in Malaysia translates into a higher quality of life for entrepreneurs and their families. They can enjoy comfortable lifestyles while saving on everyday expenses.

Diverse Culture and Experiences: Malaysia's rich cultural diversity offers vibrant lifestyle choices ranging from culinary delights to festivals that celebrate various traditions.

Natural Beauty and Attractions: Entrepreneurs can unwind amidst Malaysia's stunning natural landscapes, from pristine beaches to lush rainforests, providing ample opportunities for leisure activities.

Challenges and Considerations

While the prospects are promising, there are challenges that entrepreneurs should consider:

Bureaucracy and Regulations: Navigating local regulations can be daunting due to bureaucratic processes that may slow down business operations.

Competition: The competitive landscape in Malaysia requires businesses to have a strong value proposition to differentiate themselves from local players.

Cultural Nuances: Understanding local cultural nuances is vital for successful business interactions. Respecting these differences can lead to stronger relationships with partners and customers alike.

Malaysia stands out as an attractive destination for Singaporean entrepreneurs seeking new growth opportunities.

Its geographical proximity, cultural affinity, cost advantages, market access, developed infrastructure, skilled talent pool, and high quality of life make it an appealing choice for business expansion.

Singaporean entrepreneurs should explore the potential of starting or expanding their businesses in Malaysia actively.

By leveraging the unique advantages offered by this vibrant market, they can position themselves for success in the ever-evolving landscape of Southeast Asia.

Relevant Resources

- Malaysian Investment Development Authority (MIDA): MIDA Website

- Enterprise Singapore: EnterpriseSG Website

Key Differences Between Singapore and Malaysia for Entrepreneurs

| Feature | Singapore | Malaysia |

|---|---|---|

| Cost of Living | High | Low |

| Real Estate Costs | High | Affordable |

| Labour Costs | High | Competitive |

| Language | English & Mandarin | Predominantly English |

| Business Setup Complexity | Moderate | Relatively Easy |

| Market Size | Smaller | Larger |

| Government Support | Strong | Growing |

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post