SGD 440M Investment in Deep Tech: New Innovations & What It Means for Investors

In recent months, Singapore has made headlines with its announcement of a groundbreaking SGD 440 million investment aimed at bolstering the deep tech sector. This significant funding is not just a financial boost; it represents a pivotal moment for technological advancement in the region.

Deep tech encompasses innovations often rooted in scientific discoveries and engineering, including fields such as artificial intelligence (AI), quantum computing, and biotechnology. These technologies have the potential to revolutionise industries, offering exciting opportunities for investors and entrepreneurs alike.

Deep tech is characterised by its complexity and the lengthy development cycles required to bring innovations to market. However, the potential rewards are substantial. As Singapore positions itself as a leader in this space, the implications for local investors—especially retirees and business professionals are profound.

The Significance of the SGD 440M Investment

Fueling Innovation

The injection of SGD 440 million into deep tech signifies a robust commitment from the Singaporean government to accelerate innovation. This funding will primarily support startups in their early growth stages, allowing them to scale operations and enhance their technological capabilities. By matching private-sector investments, the government aims to create a more vibrant ecosystem where startups can thrive.

Attracting Talent

Moreover, this investment is poised to attract top-tier talent from around the globe. With increased funding, deep tech companies can offer competitive salaries and benefits, drawing skilled professionals who can drive innovation forward. A thriving talent pool will further enhance Singapore's reputation as a hub for technological advancements.

Economic Growth

The economic implications of this investment are significant. By fostering innovation in deep tech, Singapore can expect job creation across various sectors—from research and development to manufacturing and services. This diversification of industries will not only strengthen the economy but also provide new opportunities for investors seeking growth in emerging markets.

Key Deep Tech Innovations to Watch

As we look ahead, several key innovations within deep tech warrant attention:

Artificial Intelligence (AI)

- Generative AI: This technology creates new content from existing data, enabling applications in art, writing, and even software development.

- AI-driven drug discovery: AI is transforming how pharmaceuticals are developed, significantly reducing timeframes and costs associated with bringing new drugs to market.

- AI-powered autonomous systems: From self-driving cars to drones used in logistics, AI is facilitating automation across various sectors.

Quantum Computing

- Quantum machine learning: This combines quantum computing with machine learning algorithms to process vast datasets more efficiently than classical computers.

- Quantum cryptography: Enhancing security protocols through quantum principles ensures that data remains safe from cyber threats.

- Quantum simulation: This allows researchers to model complex systems that are otherwise impossible to simulate accurately.

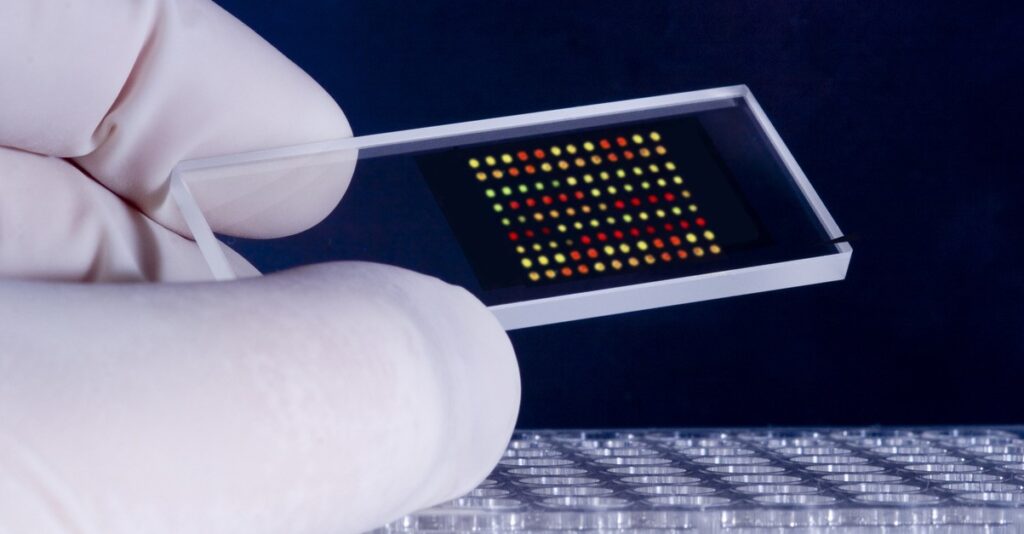

Biotechnology

- Synthetic biology: Engineering biological systems for useful purposes has applications ranging from agriculture to medicine.

- Gene editing: Technologies like CRISPR are revolutionising genetics by allowing precise modifications to DNA.

- Regenerative medicine: Innovations in this field aim to repair or replace damaged tissues and organs.

Other Emerging Technologies

- Nanotechnology: Manipulating matter at an atomic level opens doors for advancements in materials science and medicine.

- Advanced materials: New materials are being developed that can withstand extreme conditions or possess unique properties.

- Clean energy technologies: Innovations aimed at sustainability will play a crucial role in addressing climate change challenges.

Investment Opportunities in Deep Tech

For Singaporean investors looking to capitalise on this burgeoning sector, several avenues exist:

Direct Investment

Investing directly in promising deep tech startups can yield high returns. Many startups are seeking capital to scale their operations and bring innovative solutions to market.

| Category | Deep Tech Investments | Traditional Asset Classes |

|---|---|---|

| Return on Investment (ROI) | Average net IRR: 15-16% (higher than traditional tech funds at ~10%) | Predictable returns, e.g., government bonds yield 4-5% |

| Investment Timeframes | Median time to unicorn: ~6 years; median exit: ~7 years | Shorter timeframes for other tech sectors |

| Risk and Volatility | High risks (tech obsolescence, regulatory challenges); potential for outsized returns | Lower but more predictable returns; requires higher risk tolerance |

| Comparisons | Higher long-term returns with variability and risk | Average annual return: 7-10% for stocks |

| Investor Consideration | Assess risk tolerance and consider portfolio diversification | Balance deep tech with traditional assets to mitigate risks |

Data reflects insights from McKinsey and Octopus Ventures as of November 2024.

Minimum Investment Amounts

Venture Capital (VC): Deep tech VC firms typically require minimum investments of USD 100,000 (SGD 137,000) to USD 1 million (SGD 1 million), depending on the firm and investment stage (seed vs. Series A). Notable firms like SOSV and Alumni Ventures focus on early-stage startups with varying minimums.

Notable VC Funds in Singapore SOSV: A global fund with over $1.5 billion AUM, focusing on biotech and advanced materials, actively funding in Singapore. SGInnovate: A government-backed firm supporting deep tech startups, co-investing in sectors like healthcare and AI.

ETFs and Public Companies: Tech-focused ETFs have much lower minimums, often starting at the price of a single share. For example, top-performing ETFs like the VanEck Semiconductor ETF and AXS Esoterica NextG Economy ETF allow investments of just a few hundred dollars.

Investment Risks

While the potential rewards of investing in deep tech are significant, it is essential to consider the associated risks. The lengthy development cycles and high costs of research can lead to uncertainty regarding returns on investment.

For instance, biotech developments might take 10-15 years to commercialize, while AI applications might reach market viability within 5-8 years. As such, long-term investors might find biotech more suitable, while those with medium-term goals might favor sectors like AI or clean energy technologies.

Because of these timelines, investors need to align their financial goals with the specific sector's development horizon.

Additionally, deep tech investments face unique risks like technology obsolescence, where rapid innovation can outdate a technology before it generates returns, and liquidity concerns, as exit opportunities are often limited until an acquisition or IPO.

Rewards of Investing in Deep Tech

Deep tech investing offers substantial rewards by disrupting industries and addressing global challenges, often yielding higher returns than traditional investments. Key benefits include:

High Growth Potential: Deep tech companies tackle foundational issues like healthcare and energy sustainability, leading to exponential growth. Innovations in biotech and AI can create multi-billion-dollar markets, providing exceptional returns for early investors. Competitive Edge: Companies with strong intellectual property (IP) enjoy high barriers to entry, allowing them to establish market leadership and sustained profitability, making it difficult for competitors to replicate their technologies. Societal Impact: Deep tech investments align with socially responsible goals by addressing challenges such as climate change and healthcare access, attracting ESG investors interested in clean energy and other sustainable solutions. Lucrative Exit Opportunities: Early-stage deep tech startups can yield significant returns for venture capitalists and angel investors, especially if they achieve milestones that lead to acquisitions or public offerings.

The Future of Deep Tech

Long-Term Impact

The long-term implications of advancements in deep tech extend beyond economic growth. These technologies have the potential to address pressing global challenges such as healthcare accessibility, climate change, and food security.

Ethical Considerations

As with any emerging technology, ethical considerations must be addressed. The rapid pace of innovation raises questions about privacy, security, and societal impacts. Investors should advocate for responsible practices that prioritise ethical standards alongside technological progress.

Global Competition

Singapore's investment in deep tech positions it competitively on the global stage. As other nations ramp up their own efforts in this area, early adoption will be crucial for maintaining an edge. Investors should keep an eye on international trends that may influence local markets.

Conclusion

The SGD 440 million investment into Singapore's deep tech sector marks a significant step towards fostering innovation and economic growth. As we have explored throughout this article, key areas such as AI, quantum computing, and biotechnology present exciting opportunities for both startups and investors alike.

The future of deep tech holds immense promise—not just for economic returns but also for societal advancement. As such, it is imperative for Singaporean investors, especially retirees and working professionals to stay informed about developments within this transformative field.

Final Thoughts

The landscape of technology is evolving rapidly. Embracing these changes offers not only potential financial rewards but also the chance to be part of something greater—shaping a future that leverages innovation for good.

P.S. This is not investment advice - always do your own research and consider your personal financial situation!

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post