SME Owners: Grants, Funding Schemes, Digital Transformation Support - SG Budget 2025

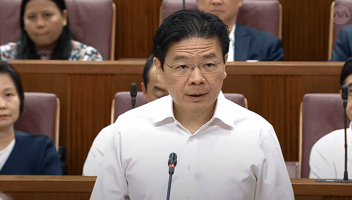

The Singapore Budget 2025, presented on February 18, 2025, by Prime Minister Lawrence Wong, focuses on empowering SMEs to thrive in a competitive global landscape.

With SMEs forming the backbone of Singapore's economy, this budget introduces a range of grants and funding schemes to support business growth, digital transformation, and sustainability efforts.

This article will guide you through these opportunities, ensuring you can make informed decisions to enhance your business.

How to Apply and Maximise Benefits

Applying for these grants involves checking eligibility on the Business Grants Portal, preparing necessary documents like financial statements, and submitting applications through relevant agencies like Enterprise Singapore.

To maximise approvals, seek professional advice, ensure applications are complete, and monitor deadlines closely.

Detailed Analysis on SG Budget 2025 for SME Owners

1. Grants & Funding Support for SMEs

SMEs can leverage various financial support mechanisms to drive growth and development, as outlined below:

1.1 Business Growth & Expansion Grants

-

Enterprise Development Grant (EDG): Managed by Enterprise Singapore, this existing grant supports projects in Core Capabilities, Innovation & Productivity, and Market Access, offering up to 50% funding for eligible costs. From April 1, 2023, to March 31, 2026, sustainability projects can receive up to 70% support. Eligible applicants must be Singapore-registered companies with at least 30% local equity. Ideal for business upgrades, innovation, and overseas expansion.

-

The Global Founder Programme: Announced in Singapore's Budget 2025, aims to attract experienced entrepreneurs and multinational companies to establish and grow in Singapore. Led by the Singapore Economic Development Board (EDB), it seeks to strengthen Singapore's role as a hub for innovation and enterprise.

Note: Further details about the Global Founder Programme are expected to be released by the EDB in the coming months.

1.2 Workforce & Talent Development Schemes

- Productivity Solutions Grant (PSG): Launched in 2018, the existing and continuing PSG covers up to 50% of IT solutions and equipment costs (capped at S$30,000) to boost productivity. It includes sector-specific and generic solutions like customer management and data analytics.

- Wage & Training Support: The SkillsFuture Enterprise Credit (extended to June 30, 2025) provides S$10,000 per enterprise for training and upskilling. Companies with at least three resident employees will receive a new S$10,000 credit in the second half of 2026, valid for three years. Meanwhile, the current SFEC will be extended until the new credit is available.

- SkillsFuture Workforce Development Grant: A new grant will be introduced to consolidate existing schemes from Workforce Singapore and SkillsFuture Singapore, simplifying the application process. This grant will provide higher funding support of up to 70% for job redesign activities, aiding companies in workforce transformation.

2. Digital Transformation & Tech Adoption Support

Digital transformation is a cornerstone of Budget 2025, with several initiatives to help SMEs leverage technology for growth.

2.1 New & Expanded Digitalisation Grants

- SME Go Digital: Launched in 2017, this IMDA & Enterprise Singapore programme helps SMEs adopt digital solutions through Industry Digital Plans (IDPs), guiding them in readiness, adoption, and scaling. Over 78,000 SMEs joined by 2020.

- Cloud & AI Grants: The existing and continuing Productivity Solutions Grant (PSG) provides funding for cloud and AI solutions, covering up to 50% of eligible costs. To qualify, SMEs must be registered and operating in Singapore, have at least 30% local shareholding, and use the solutions they have purchased within the country.

- Meanwhile, the Enterprise Compute Initiative (Budget 2025) allocates S$150M to boost AI adoption, providing SMEs with tools, resources, and expert consulting.

- National Productivity Fund Top-Up: An additional S$3 billion has been injected into the National Productivity Fund. This funding is intended to enhance competitiveness and assist SMEs in scaling and digitising their operations, with a particular focus on AI adoption and automation.

Note: The SMEs Go Digital programme and the PSG are ongoing initiatives that continue to receive support from SG Budget 2025.

3. Sustainability & Green Business Incentives

Sustainability is a growing priority, with specific incentives to help SMEs adopt green practices.

-

Green Innovation Grants: Includes the existing and continuing Energy Efficiency Grant (EEG), which co-funds up to 70% and up to 30% for non-SMEs, applicable until 31 March 2026.. The co-funding is applicable for using energy-efficient equipment in food services, manufacturing, retail, construction, data centres and maritime sectors to cut costs and emissions.

-

Carbon Reduction Incentives: The Carbon Tax and related schemes reward businesses for adopting low-carbon technologies, supporting Singapore’s Green Plan 2030.

To encourage the adoption of low-carbon technologies, the carbon tax rate has been set at S$25 per tonne of CO₂ equivalent from 2024, with planned increases to S$45 per tonne in 2026 and 2027, aiming for S$50 to S$80 per tonne by 2030.This escalation is designed to incentivise businesses to reduce emissions and invest in sustainable practices.

4. How to Apply for These Grants & Support Schemes

Applying for these grants requires careful planning to ensure success. Here’s a step-by-step guide:

- Step 1: Check Eligibility: Review the eligibility criteria for each grant on the Business Grants Portal. Common requirements include being a Singapore-registered company with at least 30% local equity and meeting turnover or employment size thresholds.

- Step 2: Identify Relevant Grants: Use the e-Adviser tool on the GoBusiness website to find grants that match your business needs, such as EDG for expansion or PSG for digital solutions.

- Step 3: Prepare Documentation: Gather necessary documents, including financial statements, business plans, and project proposals. Ensure all information is accurate and up-to-date.

- Step 4: Submit Application: Apply through the Business Grants Portal or directly to agencies like Enterprise Singapore.

- Step 5: Monitor and Follow Up: Track application status and respond promptly to any requests for additional information. Claims for reimbursement-based grants like EDG must be submitted within six months of project completion.

- Tips for Maximising Approvals: Seek professional advice from consultants or industry associations, ensure applications are complete, and align projects with national priorities like digitalisation and sustainability to strengthen your case.

Analytical Insights and Value-Added Tips

- Key Insights: The Enterprise Compute Initiative highlights Singapore’s push to be a tech hub, giving SMEs an edge in AI and cloud adoption for global growth.

- Tips: Focus on grants that support long-term goals (e.g., EDG for expansion, PSG for automation). Leverage industry groups such as Association of Small Medium Enterprises (ASME) for resources and networking. Stay updated via GoBusiness for new grants and extensions.

SG Budget 2025 provides a robust framework for SME owners to access grants and funding for growth, digital transformation, and sustainability.

By leveraging programmes like EDG, PSG, and SME Go Digital, SMEs can enhance their competitiveness and contribute to Singapore's economic resilience.

Stay proactive, seek expert guidance, and capitalize on these opportunities to drive your business forward.

Key Citations

- Singapore Budget 2025 official website

- Enterprise Singapore financial support

- Infocomm Media Development Authority SMEs Go Digital

Read more about Singapore Budget

- Singapore Budget Summary

- Singapore’s Integrated Shield Plan: Latest Updates in 2025

- SG Budget 2025 - What’s In It for HDB Owners

- Singapore IPO Drought: What’s Driving Companies Away from SGX?

- Here’s How You Can Use Your MediLife and Medisave under the SG Budget 2025 Incentives

- DNA Chip Investment to Boost Healthcare, Jobs & Global Biotech Leadership

- SG Budget 2025: Programmes Addressing Needs Across Life Stages

- Building Our Singapore Together: SG60 Highlights in Budget 2025

- Budget 2025: Strategies to Boost Singapore's Business Landscape

- Singapore Budget for Working Professionals

- Singapore Budget 2025: Disbursement Timeline for Working Professionals

- Singapore Budget 2025: 6 Key Support Measures for Working Adults with Elderly Parents

- Singapore Budget 2025: Disbursement Timeline for Business Owners and SMEs

- SG Budget 2025: How Much Will Parents Save on Their Kids (Monthly) with More Support Given

- SG Budget 2025: Fresh SGD 10,000 SkillsFuture Credit for SME Workforce Transformation

- SG Budget 2025: Accelerating Clean Living with EV Incentives in Singapore

- Singapore Budget 2025: Key Support Measures for Business Owners and SMEs

- Singapore Budget 2025: Strategic Levers for Business Growth and Innovation

- Singapore Budget 2025: Nuclear Energy Ambitions & ASEAN Integration – Global Trends and Local Realities

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post